The CaseMine Bankruptcy Module

Bankruptcy is a federally authorized procedure by which a debtor, an individual, corporation, or municipality is relieved of total liability for its debts by making court-approved arrangements for their partial repayment.

Through bankruptcy, debtors liquidate their assets or restructure their finances to fund their debts. Bankruptcy law provides that individual debtors may keep certain exempt assets, such as a home, a car, and common household goods, thus maintaining a basic standard of living while working to repay creditors.

The law of bankruptcy in the United States is governed primarily by federal law. Specialized federal bankruptcy courts hear bankruptcy cases and related proceedings.

The Bankruptcy Code appears in title 11 of the United States Code, beginning at 11 U.S.C. 101. Its principal chapters are 7, 11, 12, 13 and 15.

Considering filing a Petition for Bankruptcy? At CaseMine, we have collated all the resources you might need.

Filing for Bankruptcy? Here's what you need to know:

1) What is Bankruptcy?

When an individual or an organisation is unable to honour their monetary obligations, they file for Bankruptcy.

Bankruptcy cases are either voluntary or involuntary. In voluntary bankruptcy cases, which account for the overwhelming majority of cases,

debtors petition the bankruptcy court. With involuntary bankruptcy, creditors, rather than the debtor, file the petition in bankruptcy.

A fundamental goal of the federal bankruptcy laws enacted by Congress is to give debtors a financial "fresh start" from burdensome debts.

1.1 A general introduction to Bankruptcy https://www.uscourts.gov/services-forms/bankruptcy

2) How do the courts in USA deal with Bankruptcy?

The Bankruptcy Code appears in title 11 of the United States Code, beginning at 11 U.S.C. 101. Its principal chapters are 7, 11, 12, 13 and 15. The procedural aspects of the bankruptcy process are governed by the Federal Rules of Bankruptcy Procedure (often called the "Bankruptcy Rules") and local rules of each bankruptcy court.

2.1 Read for an overview of which chapter applies to you https://www.justice.gov/ust/bankruptcy-fact-sheets/overview-bankruptcy-chapters

2.2 A more detailed explanation for the requirements under each chapter can be found at: https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics

3) Statutes and Forms

Here are all the different provisions of title 11 as well as the various forms which are likely to be used for filing the bankruptcy petition.

3.1 The Applicable Statute: https://www.law.cornell.edu/uscode/text/11

3.2 Bankruptcy Forms: https://www.uscourts.gov/forms/bankruptcy-forms

4) Who may file for Bankruptcy?

The process of filing for Bankruptcy is in two parts- one for individuals, and one for corporations/ partnerships etc. As such, they can be bifurcated into:

Consumer Bankruptcy:

The most common bankruptcy filing for individuals is under Chapter 13 of the Bankruptcy Code, which:

- provides for the filing of a reorganization plan setting forth a repayment schedule

- applies to individuals with a regular income who have unsecured debts of less than $250,000, and secured debts of less than $750,000, and

- the reorganization plan must be submitted within fifteen days of filing a bankruptcy petition, and may not exceed five years in duration.

Individuals may also file under Chapter 7, which:

- provides for appointment of a bankruptcy trustee to liquidate the debtor's non-exempt assets and

- to assess claims of creditors and pay as many of the petitioner's debts as possible,

- while leaving the debtor sufficient assets to carry on.

Individual debtors who have debts in excess of the Chapter 13 limits, or who own substantial nonexempt assets, can also file for reorganization under Chapter 11.

The property of a bankruptcy estate is determined according to 11 U.S.C. § 541. State law governs exemption of certain property.

Commercial Bankruptcy:

A corporation or partnership can petition for bankruptcy relief under Chapters 7 or 11 of the Bankruptcy Code, but businesses often file a reorganization plan under Chapter 11 to keep their businesses alive and pay their creditors over time.

The debtor entity acts as its own trustee in Chapter 11 proceedings, filing a disclosure statement and reorganization plan with the court, detailing a payment structure that will impair the rights of most or all of the creditors. The debtor's creditors must approve the filed reorganization plan. Chapter 11 permits a business to emerge from bankruptcy after the reorganization plan is completed.

5) Finding the right precedent for your Bankruptcy Petition

As you fill out the various forms as mandated under Title 11, it is important to stay abreast of all the day to day judicial opinions which could have a direct bearing on the outcome of your petition.

The individuals and business who file for bankruptcy have far more debts than money to cover them and don't see that changing anytime soon. Filing for bankruptcy is a legal process that either reduces, restructures or eliminates your debts. Whether one gets that opportunity is up to the bankruptcy court.

CaseMine has different tools designed to assist you in each and every step of this journey- from the very first step, till the last.

Filing the bankruptcy petition: Legal counsel is not a requirement for individuals filing for bankruptcy, but you are taking a serious risk if represent yourself. A bankruptcy case presents last minute hearings, surprise creditor attacks and insurmountable challenges. Understanding federal and state bankruptcy laws and rules, and knowing which ones apply to your case, is essential. Judges are not permitted to offer advice, and neither are court employees. There also are many forms to complete and some important differences between various kinds of bankruptcy one should be aware of before taking a decision. If proper procedures and rules in court are not followed, it could adversely affect the outcome of a bankruptcy case.

Often, when considering the facts and issues of a given petition, judges and lawyers will draw parallels from similar cases decided in the past, in order to maintain uniformity in the application of law. More importantly, judges of subordinate courts are bound by the decisions of superior courts on any particular legal issue, where the judgment of the superior court is called a "precedent".

Evidently, being armed with the correct precedents increases the chances of your petition being allowed by the court. The problem? Traditional methods of finding precedents involve going through humungous law books and multiple trials of different keywords, before you find a case law that matches not just the legal issues, but also the facts of your case.

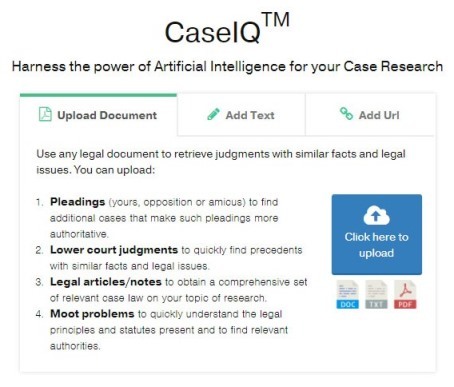

How does CaseMine help you in this situation? Instead of asking you to read through thousands of pages, CaseIQ, our AI-powered search engine allows you to upload your entire petition, and analyses it in order to suggest the most relevant precedents specific to your circumstances.

6) Researching on the application of Bankruptcy Law with CaseMine

An integral part of initiating any litigation involves understanding the different sections and provisions of law that one will be subjected to. Filing for Bankruptcy is no different.

Title 11 of the US Code deals with Bankruptcy, where different chapters have provisions dealing with various situations, for Individuals filing for bankruptcy, as well as for Corporations and municipalities.

For example, Chapter 7 of the bankruptcy code is a chance to get a court judgment that releases you from responsibility for repaying debts and permits to keep key assets that are considered "exempt" On the other hand, Chapter 13 is an option for people who do not want to give up their property or do not qualify for Chapter 7 because their income is too high. Chapter 9 protects municipalities from creditors while the city develops a plan for handling its debts. Chapter 11 is designed to give businesses a chance to stay open while they restructure the debts and assets in order to pay back creditors.

Apart from these, there exist numerous forms for each stage of every type of bankruptcy, from the initial collation of creditor's claims, to the stage where a debt re-organisation plan is successfully in place, ready to be executed.

Naturally, one of the most important aspects of filing for bankruptcy involves understanding these legal provisions at the State and Federal level, and how they affect your particular financial situation.

CaseMine helps you in a two pronged manner - first, it gives you access to the various legal provisions, procedural rules and forms at one place, so that you don't struggle with finding the right law.

Secondly, it shows case laws where these provisions have been interpreted, so that you understand the practical application of a statute. CaseMine's CiteText feature shows you most authoritative precedent on any given provision, thus telling you how the courts have interpreted it in the past.

Use CaseIQ to get acquainted with the correct law on an issue. Study cases and briefs where similar questions of law have been raised, and analyse how they have been dealt with by various courts. Looking for the correct points of law that would make your petition stronger? Using AI to analyse your petition and compare it to similar cases in the past, our Suggested Arguments feature brings up those arguments which have been used in past cases, but are missing from your current petition. Including these points of law into your arguments helps build a petition that is highly likely to succeed. Use the experience of a large number of highly skilled bankruptcy attorneys to draft your case.

When you file for Bankruptcy under Chapter 13, the court may allow you to design a three- to five-year repayment plan for your creditors. Use CaseIQ to pull up similar cases and opt for a repayment plan after taking a good look on the other qualified plans present in these past opinions.

Similarly, city debt planners can take help of past decisions protecting municipalities for filing a chapter 9 bankruptcy petition. Use our specialised Court Filters to analyse case law in your jurisdiction, to discover the factors which have led to past approvals for "restructured debts and assets" in the earlier decisions.

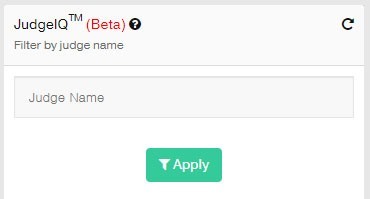

When it comes to the application of statute, we understand that judicial viewpoints differ greatly from one state to another. CaseMine's JudgeIQ filter allows you to see how a particular judge has ruled on a given issue in the past. Anticipating the questions of the judge ensures that you are well prepared for the hearing of your bankruptcy petition.

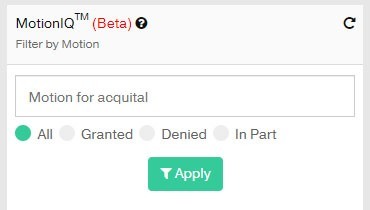

Similarly, the MotionIQ filter allows users to search for case law on the basis of grant or denial of a particular motion, thus acting as a litmus test for the practical viability of the petition. For example, you can use the Court filer along with Motion IQ to know the chances of a particular motion succeeding, filed in the California State Court.

At CaseMine, we understand that litigation involves substantial time, effort and cost. It is for this very reason, that we have designed tools that assist you at every step of the process of filing for Bankruptcy. Use the power of technology to assist your counsel with applicable precedents, the correct legal grounds and arguments. Our goal? To help you prepare a strong, winnable Bankruptcy Petition.

Do not worry, at CaseMine, we adhere to the strictest standards of data privacy and confidentiality - read more at our privacy policy.